A base rate is a banking term that leaves people confused. What is it? What does a base rate represent? How is it calculated? Those are all questions that people ask but have difficulties finding answers to. Well, if you’re interested in what a base rate is, then you’re in the right place.

What Is A Base Rate?

A base rate is an interest that a country’s central bank charges to commercial banks. You can think of it as an interest rate that every bank pays whenever taking a loan from a central bank. You might think that a base rate is something that doesn’t concern consumers. But it’s absolutely important to understand that the base rate oftentimes depends on the state of a country’s economy. If the economy is bad, the base rate will be higher. A more thriving economy means a central bank can give more favorable rates to commercial banks. In turn, the commercial bank will give more favorable rates to consumers.

How Does Base Rate Affect Consumers?

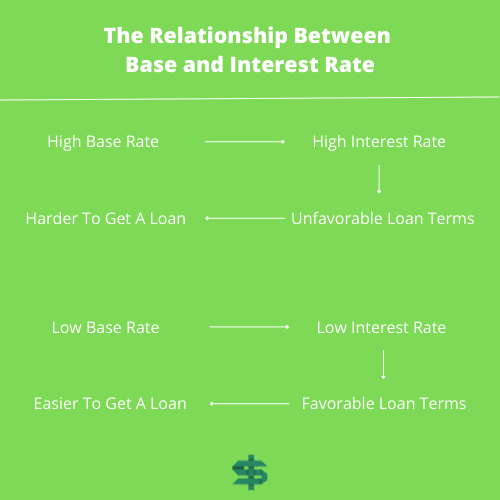

Given what we said earlier, no consumer wants a high base rate. Commercial banks will adjust their interest rates based on the central bank’s base rates. So a worst-case scenario would be a high base rate. With that said, these two terms aren’t connected. A commercial bank might still keep its interest rates the same even if the base rate increases. But that would be damaging for the commercial bank’s finances.

The higher the base rate, the more expensive loans will become for consumers. As also mentioned previously, a higher base rate suggests that a country is in a poor economy. Higher interest rate loans become more expensive to maintain, which leaves consumers having to pay more. It’s a vicious cycle where the only good outcome is for the base rate to be much lower.

After the 2008 financial crisis, central banks decided to keep the base rate low. This, in turn, helped stimulate the economy since banks could offer more favorable loans. So we know the correlation between base and interest rate in regards to loans. But what about interest-based accounts?

Consumers with interest-rate savings account benefit from the opposite. If the base rate is low, then they see a lower return on interest payments. But if the base rate is much higher, the consumers will see greater returns. So a good personal finance tip is to open up an interest-based savings account when the base rate is higher.

How Is the Base Rate Set?

With all that said, how do central banks set the base rate? As mentioned previously, a commercial bank doesn’t have to set the interest rates based on the base rate. But considering that each country has multiple different commercial banks, these establishments will monitor each other’s interest rates and set theirs accordingly. So even if a particular bank offers much lower interest rates, they will be outperformed by the banks with higher rates.

Each country’s monetary policy affects the overall banking system. This system is influenced by a couple of factors, such as the total reserve requirements, the total buying and selling of securities, and more. These factors are called market-based factors. Other factors are inflation-based and volatile-based.

Commercial banks use a lot of these factors to determine their interest rates. However, since the goal is to maximize profits for shareholders, they will usually turn to the base rate when the base rate is higher. Consumers and businesses, on the other hand, want lower interest rates. So borrowing money when inflation is high is a good way to achieve that. But inflation is a double-edged sword. Ideally, consumers get the best rates when the commercial bank is motivated to lend money.