When it comes to personal finance tips, young adults are left to fend for themselves. Schools and colleges offer no education on how a person should conduct their finances. While the reasons for that may be many, we believe personal finance should be talked about more often.

That’s why we’re here to give you our ten personal finance tips. But there is a catch to it. These tips work for everyone, and that’s what makes them so great. So feel free to stick around as we’ll get into it right now.

Read About Personal Finance

The best way to control your finances is to educate yourself on how to do it. While access to information on the internet is available to anyone, very few people take the time to do it. But you’d be surprised how important financial literacy is.

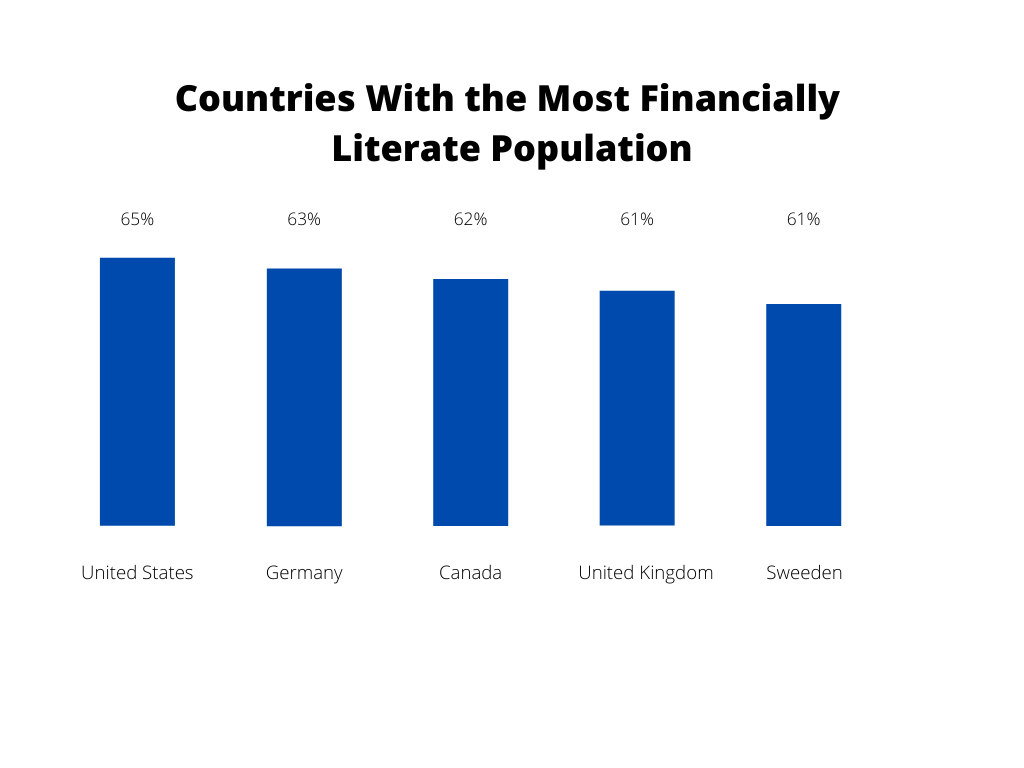

Financial literacy is all about learning the skills necessary to manage your money. Considering that this is a very valuable skill to have, allow us to point out a very interesting statistic. Namely, the western world is the most financially literate.

The United States, Canada, Australia, England, Germany, and Scandinavian countries have the most financially literate population. This graph details the percentages among these countries.

The more you read about personal finance, the more you educate yourself on how to manage your money. It is a valuable tip that anyone can use to manage their finances.

Create A Budget

A budget is a get-out-of-financial trouble card that anyone can use. We place a lot of emphasis on creating a budget. Make no mistake about it; everyone benefits by knowing how much money they make and how much they spend. To create a budget, all you need to do is simply write down your salary and other income and compare it with your expenditures.

Budgeting is a tool that, at the end of it, tells you how much money you have left. With plenty of budgeting tips on the internet, budgeting is one of those personal finance tips to first start with. This is an important step to the next tip on this list.

Think About Saving

The reason why you need a budget is that it helps you with saving. By knowing how much money you have left, you can think about allocating a percentage to a savings account. There are tons of ways to save. You can open a savings account, an emergency account, or anything else that helps you save money.

According to CNBC, 65% of Americans save little to nothing. This damning statistic paints a grim picture. The reasons why Americans aren’t saving can be down to many things. Many people also save in the form of investing. By investing in stocks, Americans have some form of backup plan. But what if your investments don’t payout? What if the stock plummets? To avoid a financial disaster, it’s best to open up a savings account and start saving your money.

Think About Paying Your Debt

Very few people live a debt-free life. While that might be the goal, getting out of debt is easier said than done. What’s even more damning is that the American household debt saw an increase in the previous year. According to the Federal Reserve Bank of New York, American households are $14.3 trillion in debt.

So with debt rising, how do you pay it off? When it comes to money tips and personal finance tips, getting this one over the line will set you up nicely on the road to financial freedom. Personal finance comes down to a few things; getting out of debt, saving, and living a better life. It is precisely why financial education is so important.

So when it comes to getting out of debt, you can do a few things. The best place to start is to pay off credit card debt. A credit card might be a convenient payment tool, but poor credit card management can rack up plenty of debt.

Think About Investing

Investing is a hot topic nowadays. Millennials are more interested in investing now than ever before. With the rise in popularity of cryptocurrencies, stocks, bonds, and other types of investment, Millennials want to get ahead and get in on the action.

Unfortunately, investing is also easier said than done. While it’s easy to fund your Robinhood account, making profits is a whole other thing. It requires in-depth knowledge on how to find a company and invest in it. More so, you have to identify hot markets that present an excellent opportunity to maximize returns. For example, we have an article about the five solar companies you should invest in. Considering that solar energy is a hot topic, the solar energy sector might present that opportunity.

Get Ahold Of Your Credit Score

Everyone that can use credit has a credit score. And everyone that has a credit score needs to know what that number is. Your credit score is a number. This number can be anywhere between 300 and 850. The higher the number, the better your finances.

So your goal is to not only know what your credit score is but to improve it as much as you can. Knowing your credit score is a personal finance tip that anyone can use in 2021.

Pay Off Your Mortgage

Mortgage debt in the US is still very high. It’s been the highest in a decade. A mortgage loan helps you secure a home. You then repay it over a duration of time, usually between 20 and 30 years, depending on the loan terms. Repayment comes in the form of monthly payments. But nothing says you can’t do it sooner. As a general rule of thumb, the quicker you pay off your mortgage loan, the less you’ll pay in fees.

But the rise of mortgage debt has to do with the rise of homeownership. The homeownership rate in the US is 65.6%.

Curb Your Spending Habits

Your lifestyle dictates your spending habits. If you live a lavish and expensive lifestyle, then you’re spending more money. But the problem arises when needing to break off from these habits. It can be hard to do that while getting used to an expensive lifestyle.

But if you want a bit of financial advice, then learn how to curb your spending habits. This way, you make it much easier to manage your finances.

Keep A Record Of What You Spend

We’ve gone through plenty of tips without mentioning taxes once. Well, sorry to break it to you, but here it goes. Taxes are scary. No one knows how to do them, and school certainly doesn’t teach us that. What we usually do is go through all kinds of personal finance articles just to get a sense of how to do our taxes.

But one way to keep everything for tax season is to keep a detailed record of your spending. By keeping a record of each transaction, you make it easier to claim all allowable income tax deductions and credits. To do that, you will have to set up a system and use it all year round.

Think About Setting Up Life Insurance

Nothing is guaranteed in life. One day you’re buying a house, while you’re in a car accident the next. Life insurance is one way to protect your family financially in the case of sudden death. But sadly, life insurance is one of those money-saving tips that we don’t talk about much. Many people think they don’t need life insurance. But this is yet another form of saving. With life insurance, you pay an amount every month. This sounds like a pretty good form of saving. But with life insurance, you invest for the future.

Whatever You Do, Start Early

Our personal finance tips work for everyone. It doesn’t matter the age; all that matters is that you start. And what better time to start than right now. The earlier you start, the more time you give yourself to secure your financial future.