The key to starting a hedge fund successfully is strategy. In the world of investing, going without a strategy is a recipe for disaster. As with trading solar company stocks, for example, to start a hedge fund, a manager needs experience. Without the necessary experience and numbers to show how good you are, attracting investors might prove more difficult.

Considering that a hedge fund is a financial service, the last thing you want is an unsuccessful launch. For that reason, we’re here to give you a 2021 guide on how to start a hedge fund. This article is designed for eager managers who are interested in starting a hedge fund.

What Is A Hedge Fund?

A hedge fund, by definition, is a pool of investments managed by one or more hedge fund managers. The goal of a hedge fund is to maximize returns for the investors. You might also think that anyone can be a hedge fund investor. But that isn’t necessarily true. While anyone can indeed invest, the barriers to entry are very high. For starters, you need to meet a few conditions. One of the conditions is to have a net worth higher than $1 million. Another condition is to show earnings of more than $200,000 in the current year.

So this alienates quite a large portion of investors. Considering that 52% of US households invest in stocks, there is a demand for it. But a significant number of households fail to meet these conditions. In all seriousness, a hedge fund is a professional service that specializes in maximizing returns. While rookie investors can easily lose their investments, a hedge fund employs analysts and comes up with risk management strategies to ensure a successful investment.

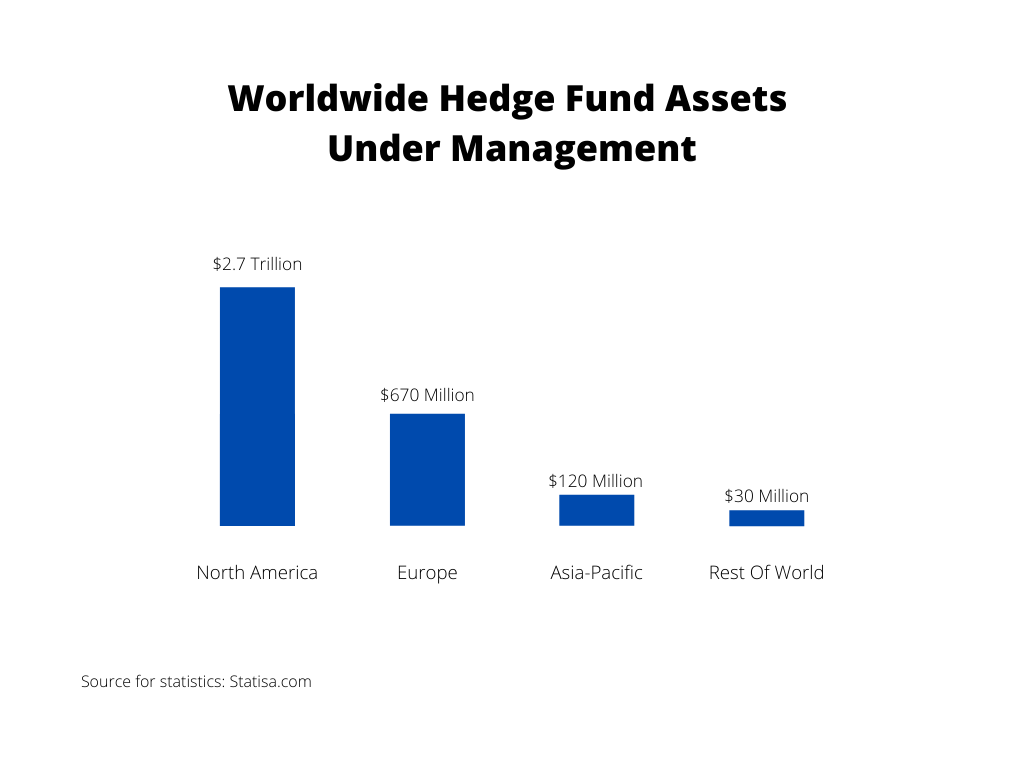

The manager also controls the investments of the hedge fund. According to Statista, the total value of assets managed by hedge funds worldwide includes $3.8 trillion. North America is the largest region of hedge fund asset management with $2.7 trillion.

How To Start A Hedge Fund? Key Takeaways

To start a hedge fund, you need a capable manager. This role is the most important one. But every manager needs a capable team of analysts, sponsors, and advisors. The hedge fund manager must coordinate with the rest of their team to ensure a successful launch. But before all that, let’s explain the process.

Business Structure, Name, and FEIN

The first step in starting a hedge fund in 2021 is to set up two business entities. The first entity is for the hedge fund, while the second business entity is for the manager. In most cases, the hedge fund needs to be a Limited Partnership (LP) or a Limited Liability Corporation (LLC). However, this doesn’t have to be the case. As for the hedge fund manager, there are no rules. The business structure can be anything that aligns with the needs of the manager.

The second step in this first part is to come up with a name. You have to stick with the name to file a series of paperwork. In this step, you must apply for a Federal Employee Identification Number (FEIN). Visit the IRS website to learn more about how to do that.

Write the Bylaws

We mentioned that a hedge fund uses a strategy to maximize returns for the investors. The type of strategy will determine the amount of paperwork necessary to register the hedge fund with the Securities and Exchange Commission (SEC) and similar regulatory bodies. In this step, you will also need to write the company’s bylaws. Writing the bylaws is essential. Otherwise, you will face difficulties registering the hedge fund with the SEC. The bylaws are a series of laws that help the hedge fund regulate itself.

Register the Hedge Fund Company As An Investment Advisor

We keep coming back to the fact that a hedge fund is supposed to maximize returns for its investors. However, the hedge fund also must provide financial advice. What this means is that the hedge fund must be registered as an investment advisor. To do that, head over to the Adviser Registration Depository (IARD) where you can perform this process for free and over the internet.

You will also have to register the representatives of the hedge fund as investment advisors. You can find more information on the IARD website.

With all that said, let’s see what investment strategies a hedge fund manager can use.

Hedge Fund Investment Strategies – An Overview

Each of these investment strategies comes with a certain level of risk. As is with anything in investing, the key is to maximize returns while minimizing risk. The most successful hedge funds utilize one or more of these strategies. These strategies are as follow:

• Long-Short Equity

• Market Neutral

• Market Arbitrage

• Convertible Arbitrage

• Credit

• Fixed-Income Arbitrage

• Global Macro

• Quantitive

• Short-Only

• Event-Driven

These strategies are all different. If you’re planning on starting a hedge fund, you probably know what these terms mean. If not, you should do your due diligence and research each strategy. Regardless of whether you’re planning on investing in copper stocks or real estate, a hedge fund manager must come up with a winning strategy that generates an active return for their investors.

Finishing Thoughts

These are the key takeaways, but this process is by no far simple. Due to the regulated nature of hedge funds, you will likely stumble upon plenty of obstacles. The complexity of these obstacles depends on a few factors. For starters, it depends on the number of investors, amount of assets, and the strategy – a fact we already stated before.

So before starting a hedge fund, do the necessary research and educate yourself on the starting process.