Copper is a valuable commodity used in many industries. From electronic devices to household applications, and even for renewable energy applications, copper stocks are looking like a good investment option for investors.

The global estimate for copper production expects to hit 27 million tons by 2025. As supply and demand widen, the following five copper stocks might present a good alternative to investors looking at long-term profits.

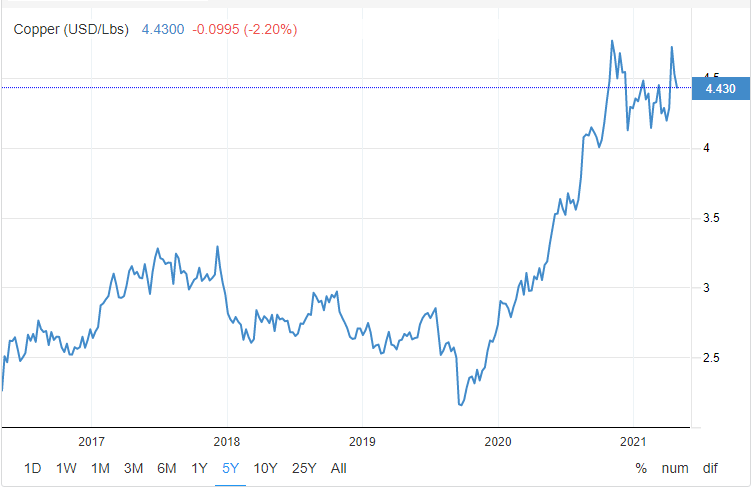

With China being the world’s largest copper producer, and the United States hot on its heels, we expect copper to hit $20,000 per metric ton in the next few years. But the copper industry has been rocked by recent developments. Namely, China has already sold more than 150,000 tons of the commodity in a bid to try and control price. This inevitably ended the copper bull run.

As prices look to stabilize, we might be in yet another bull run in the coming months. As the US announces new climate projects, the commodity will be a key ingredient to these developments. For that reason, we believe copper might hit a new all-time high in the next few years and possibly months.

Join us as we discuss why these five copper stocks are worth investing in.

Read more about the 5 solar companies you should invest in.

Table of Content

- The Top 5 Copper Stocks To Look At

The Top 5 Copper Stocks To Look At

We’ve ranked the top 5 copper stocks based on a few factors. When it comes to what makes a copper stock worth investing in, annual copper production is an important one. But the way the mining company conducts itself is also an equally important factor. Thus, we also look at business fundamentals and the number of mining projects. Let’s see what the best copper stocks are.

Barrick Gold Corporation

Barrick Gold Corporation (NYSE:GOLD) is one of the best copper stocks to look at. Not only does the company mine the commodity in more than ten countries, but they boast impressive quarterly returns. The company is already on track to achieve 2021 production targets from their mines in South America and Africa. In Q1 2021, the company made a 31% profit due to the price of the commodity rising on the market.

What helps Barrick Gold Corporation to be one of the best copper stocks out there is the fact that they also mine gold. With more than 12 gold mines throughout North America and Africa, Barric Gold Corporation is a solid investment for long-term profits. The company also reports more than $1.3 billion in investing through 49 hedge funds. Barrick Gold also hopes to open a few more copper mines in the following year. Most notably, they hope to restart mining operations in Papua New Guinea.

The current price of GOLD stocks sits at $19.39, with a one-year change of -25.08%.

Rio Tinto Plc

Rio Tinto Plc (NYSE:RIO) is a London-based, multinational metal mining company. The company primarily focuses on a few metals, including iron, gold, copper, uranium, and diamonds. With such a healthy and diverse portfolio of operations, Rio Tinto Plc is a big player in the mining industry.

Rio Tinto Plc operates in more than 35 countries across multiple continents. Their mines, smelters, and refineries bring healthy dividend profits for investors. In last year’s dividends report, Rio Tinto hit an all-time dividend high of $9 billion. The reasons for that are the increasing prices of iron. But Rio Tinto is also a big player in the copper mining sector. With three copper mining operations in 14 countries, Rio Tinto hopes to become one of the largest producers of copper in the world.

The company also expects to begin mining operations at the world’s fourth-largest copper mine in Mongolia. But a large part of the company’s copper production relies on scrap recycling. Their Kennecott mine produces more than 6.2 million pounds of copper each month. That’s enough to supply their customers in China, Japan, and the US.

The current price of RIO stocks is sitting at $64.44, with a one-year change of 19.33%.

Southern Copper Corporation

Southern Copper Corporation (NYSE:SCCO) primarily focuses on producing copper. Thus, Southern Copper Corporation is one of the world’s largest producers of the commodity. The reason why Southern Copper Corporation is a great overall copper stock is that it is the largest producer of the commodity in South America. Their South American mines in Peru, Mexico, and Chile are the largest source of copper.

What separates the mining company from others in the region is its state-of-the-art mining and refining facilities. Through the use of computerized mining and positioning systems, Southern Copper Corporation locates copper, zinc, and silver deposits and acquires new mines. They hope to open multiple mines across South America and increase copper production in the following years by as much as 112%.

The company also announced a dividend of $0.70 per share. This is due to the rise of copper, silver, and zinc over the months. With a net income of more than $750 million, Southern Copper looks to position itself as the dominant producer in the region.

The current price of SCCO stocks sits at $61.31, with a one-year change of 19.23%.

Newmont Corporation

Newmont Corporation (NYSE:NEM) is a big player in the gold mining industry. The company is the only gold mining company on the S&P 500, making it the largest producer of gold in the world. But in addition to gold, Newmont also mines copper, silver, zinc, and lead. With a base of operations on more than four continents, including North & South America, Africa, and Australia, Newmont hopes to maintain its position as the world’s largest producer of gold and other commodities.

Newmont has existed for more than 100 years. It has numerous awards and international recognitions. What makes Newmont Corporation such a great copper stock is the fact that they maintain solid numbers all year round. Their quarterly projections report an impressive $550 million profit. With several highly-promising projects in the work, Newmont is a copper stock to invest in.

The current price of NEM stocks sits at $57.54, with a one-year change of 1.8%.

Freeport-McMoRan Inc

Freeport-McMoRan Inc (NYSE:FCX) is by far one of the biggest producers of the commodity in the world. The mining company owns the highly-lucrative Grasberg mine in Indonesia. This entire mining district has some of the world’s largest copper and gold deposits.

The mining company also operates in South and North America, with more than ten mines across both continents. While their mining operations are more focused on North America, Freeport-McMoRan looks to add a few mines in the copper-rich districts of Mexico and Chile. Freeport’s Arizona mine produces more than 192 million pounds of copper each year. Unlike other copper stocks, this company primarily focuses on copper, while silver and gold are considered secondary operations.

This is precisely why you should take a look at Freeport-McMoRan as a potential copper stock investment. With healthy returns and plans to increase mining operations, we believe Freeeport-McMoRan Inc will capitalize on current momentum, and that will drive the stock price up.

The current price of FCX stocks sits at $37.00, with a one-year change of 118.32%.

Conclusion

That concludes our list of the best five copper stocks to invest in. With the price of the commodity looking at a new all-time high, we believe now is the perfect time to invest in copper stocks.